Find Your Suitable Insurance Coverage: Medicare Supplement Plans Near Me

Find Your Suitable Insurance Coverage: Medicare Supplement Plans Near Me

Blog Article

Exactly How Medicare Supplement Can Boost Your Insurance Policy Protection Today

As people browse the intricacies of healthcare plans and look for comprehensive protection, understanding the nuances of supplemental insurance becomes increasingly crucial. With an emphasis on linking the voids left by standard Medicare strategies, these extra choices use a tailored method to meeting specific demands.

The Basics of Medicare Supplements

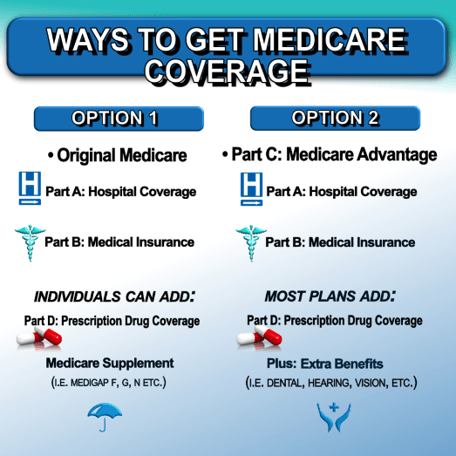

Medicare supplements, likewise called Medigap strategies, provide extra insurance coverage to fill the gaps left by original Medicare. These auxiliary strategies are offered by private insurance provider and are designed to cover expenses such as copayments, coinsurance, and deductibles that are not completely covered by Medicare Component A and Component B. It's vital to note that Medigap plans can not be used as standalone policies however job together with initial Medicare.

One trick aspect of Medicare supplements is that they are standardized across a lot of states, using the same fundamental benefits no matter the insurance policy service provider. There are ten different Medigap plans labeled A through N, each offering a different degree of insurance coverage. For example, Strategy F is just one of one of the most thorough alternatives, covering virtually all out-of-pocket costs, while other plans may offer more limited coverage at a reduced costs.

Understanding the basics of Medicare supplements is important for individuals approaching Medicare qualification that want to enhance their insurance protection and decrease potential economic problems connected with healthcare expenses.

Comprehending Coverage Options

When considering Medicare Supplement intends, it is crucial to recognize the various insurance coverage choices to make sure extensive insurance policy protection. Medicare Supplement intends, additionally understood as Medigap policies, are standardized throughout a lot of states and classified with letters from A to N, each offering varying degrees of coverage - Medicare Supplement plans near me. Furthermore, some strategies might use coverage for solutions not included in Initial Medicare, such as emergency situation care during international traveling.

Advantages of Supplemental Plans

Additionally, additional plans provide a broader variety of insurance coverage alternatives, including access to healthcare companies that might not approve Medicare task. One more advantage of extra strategies is the capability to take a trip with peace of mind, as some plans provide protection for emergency clinical solutions while abroad. On the whole, the advantages of extra strategies contribute to a more extensive and tailored approach to healthcare protection, making sure that individuals can get the treatment they require without dealing with overwhelming financial burdens.

Cost Factors To Consider and Financial Savings

Provided the financial see this security and wider coverage options given by extra plans, an important aspect to consider is the price factors to consider and possible cost savings they offer. While Medicare Supplement intends need a monthly costs in addition to the basic Medicare Component B costs, the advantages of reduced out-of-pocket expenses usually exceed the included cost. When evaluating the price of extra plans, it is necessary to compare costs, deductibles, copayments, and coinsurance across various plan types to figure out the most cost-efficient choice based upon individual medical care requirements.

By selecting a Medicare Supplement plan that covers a higher portion of health care costs, people can lessen unanticipated prices and budget much more successfully for clinical care. Eventually, investing in a Medicare Supplement plan can provide useful economic defense and tranquility of mind for recipients looking for thorough insurance coverage.

Making the Right Selection

Picking one of the most appropriate Medicare Supplement strategy demands cautious factor to consider of private healthcare demands and financial situations. With a selection of strategies readily available, it is crucial to assess factors such as coverage choices, premiums, out-of-pocket costs, service provider networks, and overall worth. Recognizing your present health and wellness status and any anticipated medical demands can assist you in selecting a plan that supplies detailed click over here now coverage for solutions you might need. Additionally, reviewing your budget plan constraints and contrasting premium expenses among various strategies can aid make sure that you select a strategy that is inexpensive in the lengthy term.

Final Thought

Report this page